The monetary policy committee met and raised interest rates to 1%. Well below inflation, but still a welcome increase. Call me old fashioned, but I do believe real interest rates should be non-negative, so the Banks interest rate would be above the inflation rate in the best of all possible worlds. However, that is not where we are: the Bank has been following a near zero interest rate policy for over a decade and it is very difficult to get interest rates back to a realistic level once inflation has gotten out of control.

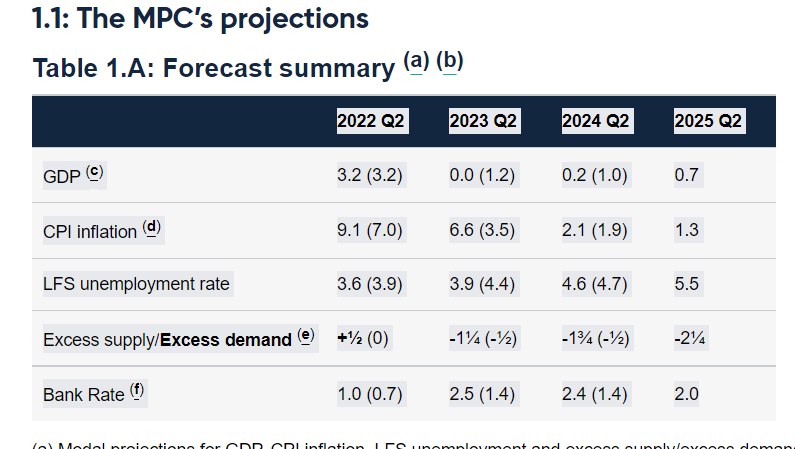

What is more interesting is the economic commentary and how this has changed since February. The big difference is the war in Ukraine itself and more importantly the “economic war” launched by the West against Russia in the form of sanctions. Let us look in a bit more detail at the difference it has made. There is a very useful Table 1A summarising the Bank of England’s forecast now (May) and its previous forecast from February in parentheses.

Firstly, inflation. In the text it suggests that inflation will peak late this year, “averaging slightly over 10% at its peak in 2022 Q4”. However, it seems to also believe that inflation will be 9.1% in 2022 Q2. The figure for 2022 Q2 was 2% lower in February, as was their predicted “peak” at 8%. Thus the advent of the war and sanctions have increased inflation for the rest of 2022 up by 2% and for 2023 by even more. However, the inflation outlook for 2023 is probably a bit optimistic. If inflation peaks at over 10% in 2022 Q4, it is unlikely to drop to 6.6% by 2023 Q2 unless Presidents Zelensky and Putin sign a comprehensive peace deal with NATO blessing soon – which seems highly unlikely. If the war drags on and sanctions intensify, there is little to bring down inflation significantly on the horizon.

The figure of 9.1% inflation for 2022 Q2 suggests a very large increase in April, to around 9% or possibly more. Now we know there will be a big effect of the April 2022 OFGEM price cap increase, but this is partly offset by the drop out of the April 2021 OFGEM increase. The net OFGEM effect will probably be 0.7%. If inflation is to be 9% in April, this means that there will also be a very large increase in non-energy items. I mention this simply because the Bank of England probably has some insider information in terms of the price increases that have already happened but not been published by the ONS. The Bank will also no doubt monitor prices itself.

However, the most interesting thing for me on this Table is interest rates: by 2024 the real interest rate will be positive, with a Bank rate at 2.4% and inflation at 2.1% ad in 2025 Q2 with Bank rate at 2% and inflation at 1.3%. The era of negative real interest rates seems set to end, if not for sometime yet!

Since the change in outlook is largely driven by the effect of the war in Ukraine and sanctions, there is a question about how long the war and the sanctions will last. Also, there is the question of how effective the sanctions will be: the more effective the sanctions on curbing Russia’s exports, the greater the effect on world supply and hence on inflation.

There is of course also the additional supply shock caused by China’s zero Covid policy. Attempts to follow a zero Covid policy of lockdowns with new and highly infectious variants of Covid will cause significant supply chain issues across for some time to come. At present, the Chinese government seems committed to the policy, despite growing evidence of its cost and impracticality.

I would recommend you to read the report itself: it is packed with lots of insightful detail!